Nigeria’s external reserves have leaped to $43.195 billion as of December 28, 2018, indicating an 11 percent increase from the $38.912 billion it was as of January 2, 2018.

This represents an increase of $4.3 billion within the period. The reserves had dropped to about $41 billion in November last year.

Save for the revenue-bolstering $5.36 billion Eurobond issued by the Federal Government last year, the country’s reserves would have depreciated significantly considering the combined effects of interest rate normalization in some advanced economies which resulted in increased capital outflows as well as the slump in crude oil price.

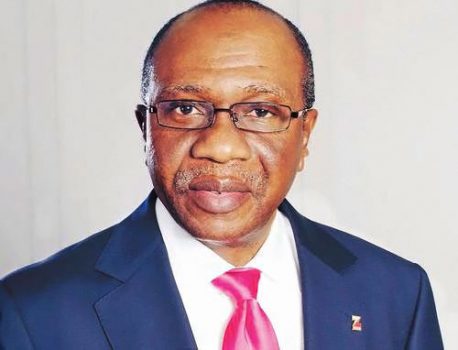

According to the Governor of the Central Bank of Nigeria (CBN), Mr. Godwin Emefiele, the ongoing interest rate normalization in the United States has been predicted to extend to some other advanced economies in Europe.

He said following the development, the nation’s apex bank would focus on maintaining a stable exchange rate so that businesses can plan and to avoid a problem in the banking system assets.

“The choice for Nigeria is to maintain a stable exchange rate so that businesses can plan and we don’t create problem in the banking system assets,” he explained.

Crude oil prices look likely to trade below $70 per barrel in 2019 as surplus production, much of it from the United States, and slowing economic growth to undermine OPEC-led efforts to shore up the market, a Reuters poll had shown.

After successfully raising $2.5 billion from the Eurobond market in February this year, the Federal Government had to raise $2.86 billion to fund its 2018 budget deficit.

AltBank, Partners Move To Establish AI-Driven Hydroponic Farm At FUNAAB

Central Bank Of Nigeria Cuts Interest Rate To 26.50%

Sterling HoldCo Confirms Full Recapitalisation Of Banking Subsidiaries

Nigeria’s Inflation Rate Slips To 15.10% In January — NBS