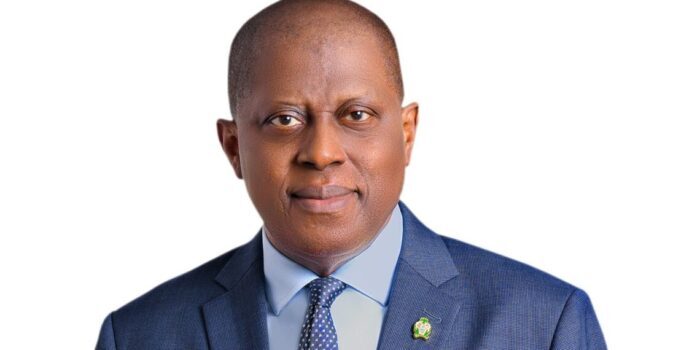

The Central Bank of Nigeria (CBN) has raised the benchmark lending rate to 26.75%, as announced by CBN Governor Olayemi Cardoso at the conclusion of the 296th Monetary Policy Committee (MPC) meeting held in Abuja on Tuesday. This decision reflects the MPC’s ongoing commitment to addressing rising inflation rates in the country.

The Central Bank of Nigeria (CBN) has raised the benchmark lending rate to 26.75%, as announced by CBN Governor Olayemi Cardoso at the conclusion of the 296th Monetary Policy Committee (MPC) meeting held in Abuja on Tuesday. This decision reflects the MPC’s ongoing commitment to addressing rising inflation rates in the country.

The MPC has maintained a hawkish stance throughout the year, increasing rates by over 500 basis points in a bid to curb inflation. The previous rate was set at 26.25% in May, but the persistent rise in inflation necessitated further action. According to the National Bureau of Statistics, the inflation rate reached 34.19% in June, marking an increase of 0.24 percentage points from May’s rate of 33.95%.

On a year-on-year basis, the headline inflation rate for June 2024 was 11.40 percentage points higher than in June 2023, which recorded an inflation rate of 22.79%. The month-on-month inflation rate for June 2024 was 2.31%, up by 0.17 percentage points from May 2024, indicating a faster increase in the average price level.

Governor Cardoso reiterated that the MPC remains steadfast in its mission to achieve price stability, emphasizing that committee members are prepared to continue tightening monetary policy until inflation is brought under control.

16 Rivers Lawmakers Defect From PDP To APC, Citing ‘Division’ In Party

Armed Forces Report Major Gains In November, Rescue 318 Kidnap Victims

CBN Introduces New Nationwide Cash-Withdrawal Limits

PDP Issues Expulsion Certificates To Wike, Fayose, 9 Others In Major Party Purge