The Federal Government has announced the exemption of 63 items from the Value-Added Tax (VAT) regime, a move aimed at promoting growth in key sectors, particularly the oil and gas industry. Taiwo Oyedele, Chairman of the Presidential Committee on Fiscal Policy and Tax Reforms, disclosed this development on Friday via a post on X (formerly Twitter).

The Federal Government has announced the exemption of 63 items from the Value-Added Tax (VAT) regime, a move aimed at promoting growth in key sectors, particularly the oil and gas industry. Taiwo Oyedele, Chairman of the Presidential Committee on Fiscal Policy and Tax Reforms, disclosed this development on Friday via a post on X (formerly Twitter).

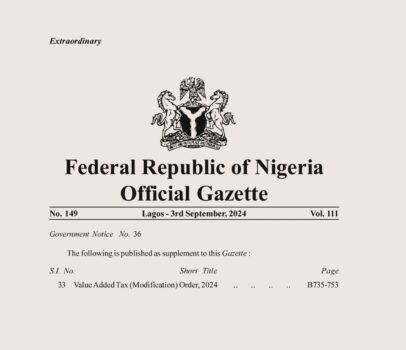

The full list of exempted items is detailed in the “Value Added Tax (Modification) Order, 2024,” an official gazette dated September 3, 2024. The announcement comes just two days after Wale Edun, Minister of Finance and Coordinating Minister of the Economy, revealed new concessions to revitalize Nigeria’s upstream and downstream oil and gas sectors. The minister introduced two key fiscal incentives: the VAT Modification Order 2024 and the notice of tax incentives for deep offshore oil and gas production under the Oil and Gas Companies (Tax Incentives, Exemption, Remission, etc.) Order 2024.

According to the official gazette, the provisions relating to Automotive Gas Oil (AGO) will be retroactively effective from October 1, 2023.

The exemptions cover a range of items across the gas, automotive, and renewable energy sectors. Notable exempted items include CNG/LPG dual-fuel vehicles, electric vehicles, CNG dispensers, gas generators, storage tanks, and LNG processing equipment. The list aims to encourage investments in environmentally friendly technologies and provide support for Nigeria’s drive toward sustainable energy solutions.

Other key items in the VAT exemption include electric vehicle batteries and charging systems, CNG and LPG buses, gas leak detectors, biogas compressors, and equipment for biofuel processing. The full list of items reflects the government’s efforts to align its tax policies with global trends and support the energy transition in Nigeria.

This tax relief is expected to benefit both manufacturers and consumers by lowering the cost of critical infrastructure, equipment, and vehicles in the oil and gas, automotive, and renewable energy sectors.

The Ministry of Finance anticipates that these exemptions will boost investments in Nigeria’s gas and biofuel sectors while promoting innovation and technological advancements, reducing tax complexities, and ensuring ease of compliance for businesses.

16 Rivers Lawmakers Defect From PDP To APC, Citing ‘Division’ In Party

Armed Forces Report Major Gains In November, Rescue 318 Kidnap Victims

CBN Introduces New Nationwide Cash-Withdrawal Limits

PDP Issues Expulsion Certificates To Wike, Fayose, 9 Others In Major Party Purge