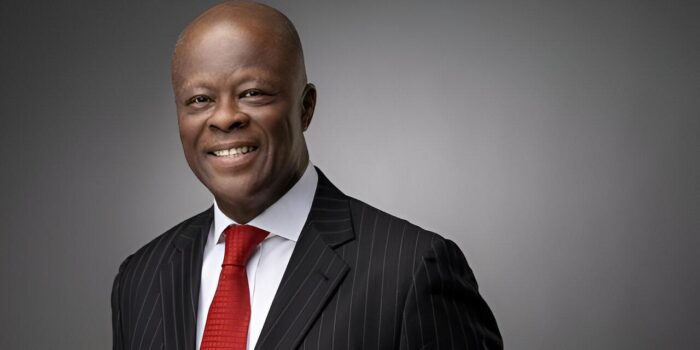

The Federal Government has announced new tax regulations aimed at reducing the tax burden on the manufacturing sector and small businesses. These changes are outlined in the “Deduction of Tax at Source (Withholding) Regulations, 2024,” signed by Wale Edun, the Minister of Finance and Coordinating Minister of the Economy, on Wednesday.

The Federal Government has announced new tax regulations aimed at reducing the tax burden on the manufacturing sector and small businesses. These changes are outlined in the “Deduction of Tax at Source (Withholding) Regulations, 2024,” signed by Wale Edun, the Minister of Finance and Coordinating Minister of the Economy, on Wednesday.

The new regulations aim to streamline tax deductions at the source, making the process less complex and promoting easier compliance for businesses. They cover payments made under the Capital Gains Tax Act, Companies Income Tax Act, Petroleum Profits Tax Act, and the Personal Income Tax Act. Among the primary objectives of the regulations are promoting global best practices, reducing tax evasion, and addressing arbitrage issues between corporate and non-corporate structures.

The regulations provide specific exemptions for small businesses, particularly those with a monthly turnover of N2 million or less and a valid Tax Identification Number (TIN). Additionally, businesses that fail to provide a TIN will face a doubled deduction rate for eligible transactions. Notably, any tax deducted at source will not be considered a separate cost or additional tax but will be treated as an advance payment toward the final tax liability of the supplier. This measure is intended to ease the burden on businesses and ensure compliance without creating unnecessary financial strain.

Failure to remit deducted taxes or to properly deduct tax at the source will incur significant penalties, consistent with existing legislation under the Federal Inland Revenue Service (FIRS) and the Personal Income Tax Act. Companies that fail to remit withheld taxes will be subject to penalties and interest as stipulated by law.

Certain transactions are exempt from the withholding tax regulations, including compensating payments under registered securities lending transactions, goods manufactured by the supplier, and telephone charges. These exemptions are designed to ensure that tax policies do not impede business activities in vital sectors such as telecommunications, energy, and manufacturing.

The regulations are set to come into effect on January 1, 2025, although some provisions allow for early application from July 1, 2024. The Federal Inland Revenue Service will provide further guidelines to ensure smooth implementation, subject to the approval of the Ministry of Finance. The introduction of the Deduction of Tax at Source (Withholding) Regulations, 2024, reflects the government’s commitment to modernizing Nigeria’s tax system, reducing inefficiencies, and encouraging compliance across various sectors, with an emphasis on boosting the manufacturing sector and supporting small businesses.

Edo Governor Lifts Suspension Of Attorney General Samson Osagie

Fubara Should Be Impeached If Found Guilty — Wike

Obasanjo Condemns Lagos-Calabar Highway Project As Wasteful

Brazil Invites President Tinubu To Strengthen Bilateral Ties