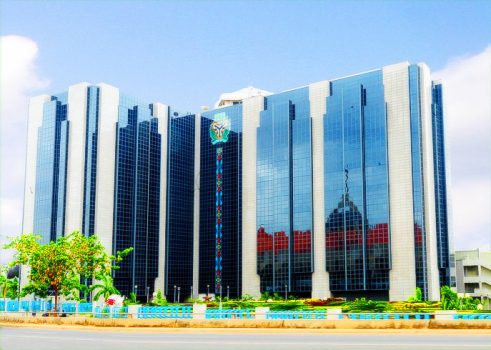

The Central Bank of Nigeria (CBN) and the Financial Reporting Council have sanctioned four commercial banks in the country between January and June for various infractions.

The Central Bank of Nigeria (CBN) and the Financial Reporting Council have sanctioned four commercial banks in the country between January and June for various infractions.

The nation’s apex bank imposed a number of sanctions on the affected banks for failure to comply with its Know-Your-Customer (KYC) guidelines and in the anti-money laundering requirement.

For its infractions, GTBank Plc was asked to pay N10 million while the United Bank for Africa (UBA) Plc and Access Bank Plc were asked to pay N8 million each. Fidelity Bank Plc was fined N4 million by the regulating body.

In its audited financial statement for six months ended June 30, GTBank said it was sanctioned N2 million for Anti-Money Laundering/Combating Financing of Terrorism (AML/CFT) regulation on three-tiered KYC and N8 million for 2018 risk-based examination findings.

The bank however explained that it was committed to fighting all forms of financial crime including money laundering, terrorist financing, bribery and corruption through the implementation of a framework for AML/CFT and the prevention of the financing and proliferation of weapons of mass destruction.

Access Bank was sanctioned N4 million over failure its to comply with anti-money laundering requirements and an additional N4 million for failure to comply with the apex bank’s manual of operations for fund transfer.

UBA was sanctioned N2 million for late resolution of customer complaints and N6 million for deficiency in account documentation/late records retrieval.

NNPC Ltd Enters Final Stages Of Preparation For Public Listing

Dangote Refinery Halts Naira Sales, Cites Dollar-Denominated Crude Costs

Court Orders Arraignment Of Ex-First Bank Executives Over Alleged ₦12.3Bn Fraud

Renaissance Energy Completes Landmark Acquisition Of SPDC